Where Does It Go?

/My lovely. COME ON:

So many puns. No Mercy on money. Where do you go, my money? Anyway. One of Dave's main principles with budgeting is that you don't wait until a certain point in time and look back to see where your money went. Instead, you tell it where to go. And we definitely do that, but I always like to take stock of how well we've actually done it. What do the numbers REALLY say? Because I would say that we stick to our budget 70 percent of the time. We are already doing better in January with cash and stick-to-itiv-ness than we were doing through the craziness that is fall.

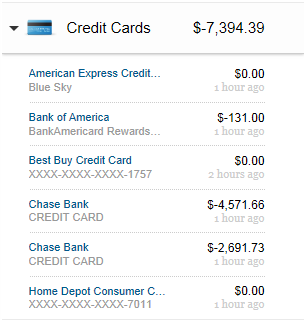

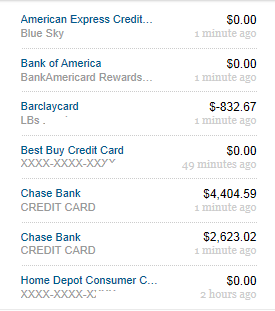

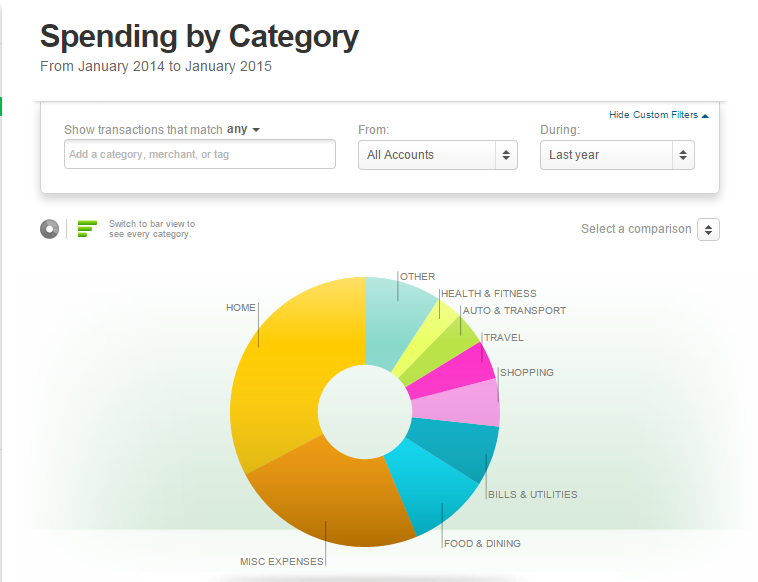

Even though I use my budgeting spreadsheet to plan where our money is SUPPOSED TO GO, I use Mint to track our spending and our overall financial picture. I like that I can include our home loan in there and sync all of our accounts (including retirement). I go in and categorize almost all of our card swipes and can parse out what categories our cash withdraws should be attributed to. So this is where our money went in 2014:

Our biggest category is the house, clearly. This includes our mortgage and ANY home improvement projects that we are doing. Next up was Miscellaneous Expenses, which seems like a really lame category to spend so much in until I tell you Misc. Expenses also included our wedding. YIKES.

The one that makes me embarrassed of myself and my stomach's constant need for pleasure is our food budget... last year we spent... $7,806 on food. And I would add at least $6-800 of cash spending on food that I didn't account for. That is upwards of $650 a month. On food.

Now listen here self. This number also basically includes our entertainment budget because that is what we do for date nights and fun with friends: we eat y'all. We feed others a lot too. Do we need to reign this in a little? Yes. Are we still going to spend a lot on food? You freaking bet ya.

We eat well and we eat well. Here is what I mean: we like YUMMY mind blowing food on one hand (i.e., not healthy, but more on the fancy spectrum. We eat well.) and we like healthy, good for you body fuel on the other (eating actually, literally, well). Also, the amount of food I eat is mind blowing sometimes. The Treans can put it away. Andy frequently says that he loves to watch me eat because he has no idea how I can eat so much. I just love food. So I take responsibility for a good portion of what some may deem "overspending."

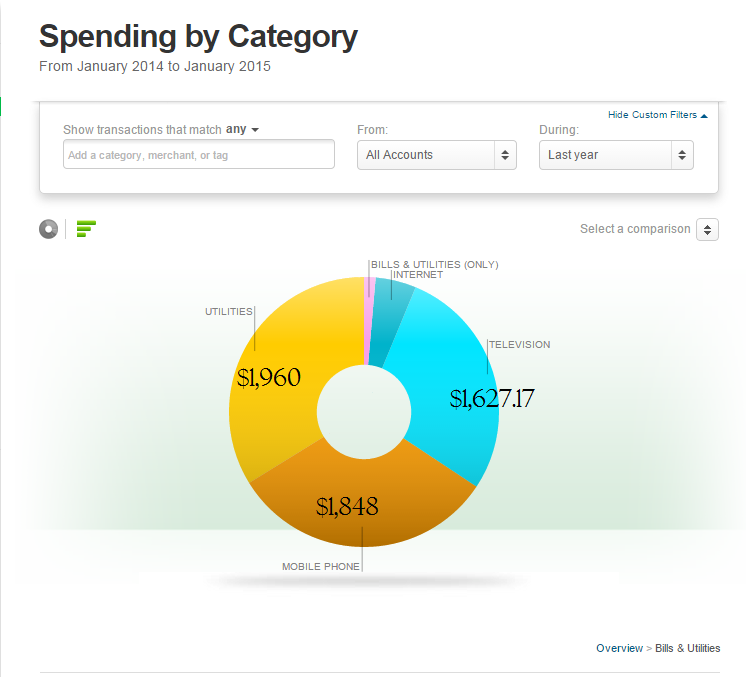

The other shockingly large area of expenses for us were bills and utilities. This includes cable, internet, electricity, water, ect. We spent $5,798 on this category. That seems super high until you break it down even further.

Our TV budget is high. It's just a fact. But we also don't go out and spend money on movies ect. We watch them from the comfort of our own tushies. Plus, we both get a lot of joy from watching all the Blazers games. The NBA league pass certainly drives up this area of our budget, but it is something we will not forgo. Speaking of TV and sports, I bit the bullet and gave up on paying for the NFL Sunday Ticket because my Seahawks AS DEFENDING CHAMPS would be playing a lot of nationally televised games. For the ones that weren't televised, we went over to Jay and Ben's. WIN WIN!

So that is where our money went last year. Pretty much what I predicted, but also a few OUCH! YIKES! OYE! Spots as well.

Where did your money go last year?

PSSSSST: if you don't know, getting set up on Mint is super easy and you can go through and populate everything to get a picture of where your money went just like I did!

PSSSSSSSSSST: this isn't a sponsored post. I just like talking about money tools. #realtalk